Mazars Economic Update

George Lagarias, our Chief Economist & David Baker, our Chief Investment Officer share their views on the impact of the COVID-19 pandemic on the Markets & Economy.

Monday 30th March 2020

The Markets

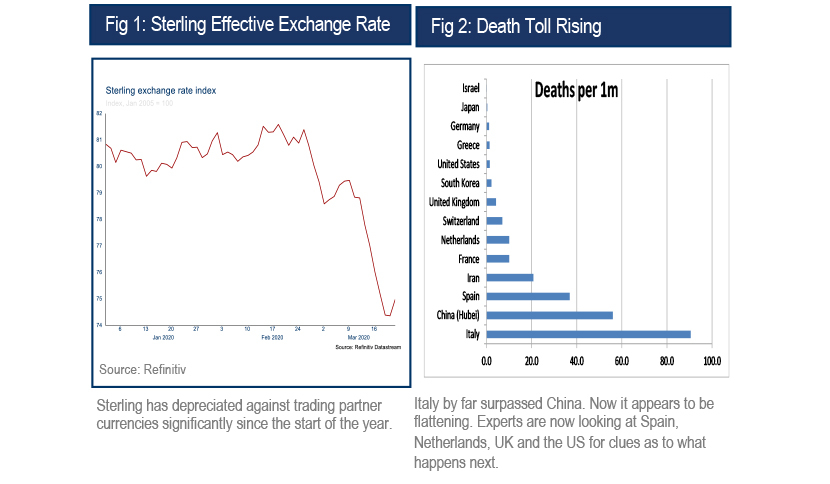

Third straight day of gains: Last week saw a resurgence of equity markets, although some profits were taken on Friday. For the week, global equities were up 10.7% (3.7% in GBP), US equities 10.3% (3.3% in GBP), UK equities 5.7%, EM up 4.9% (down 1.7% in GBP) and Japan up 13.7% (8.2%) in GBP (best performing market YTD – and only major economy not affected much by the Coronavirus). Returns for GBP were significantly lower as the GBP rose 7% against the USD and 5.7% on a trade weighted basis.

Governments and central banks have thrown the kitchen sink, but business has halted and unemployment is set to rise. The BoE cut interest rates to 0.1% and restarted its QE programme while the UK government has unveiled a plan to guarantee £330B plan for businesses and £20B direct money to businesses and households. The White House unveiled a nearly $2T plan to combat the economic effects of the virus, including cutting citizens checks (helicopter money), while the US Treasury proposed to guarantee money market funds. Single individuals will receive a $1200 tax rebate and married couples a $2400 rebate. The Fed followed through, with comments about lifting some barriers for bank loans (small businesses will need these now), buying commercial paper and some state and corporate bonds, and making accounting changes. Spain announced a €200B package and Germany a €150B package. The ECB added €750b (sovereign and corporate) QE to maintain market liquidity throughout this crisis.

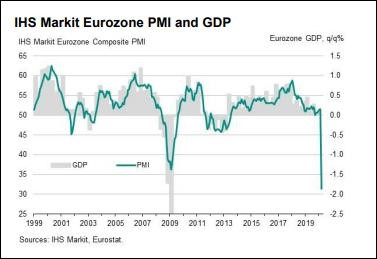

Recent European economic data unsurprisingly indicated a sharp slowdown in activity. Preliminary Purchase Manager Indices, a reliable economic activity leading indicator, suggested a record fall in economic activity in the Eurozone. The European service sector in particular, surpassed the February 2009 trough. |

The good news is, that the slump reflects policy (curfews and business shut downs) rather than sentiment. Policy is easily reversible, as opposed to sentiment. The bad news is that a lot of companies, no matter what the stimulus, might need to reduce their workforce or roll back activities altogether, due to sheer lack of cash flow. The situation favours large and listed companies, which generally have enough cash available to weather storms, and are not so reliant on day-to day cash flow. Conversely, smaller companies might be more hard pressed, and look to government schemes to mitigate some of the damage.

The economic response to the slowdown

Governments and central banks have responded forcefully and almost fully deployed their arsenal, but fact remains that business has halted and unemployment is set to rise. The BoE cut interest rates to 0.1% and restarted its QE programme while the UK government has unveiled a plan to guarantee £330B plan for businesses and £20B direct money to businesses and households. The White House unveiled a nearly $2T plan to combat the economic effects of the virus, including cutting citizens checks (helicopter money), while the US Treasury proposed to guarantee money market funds to prevent secondary order market events. Single individuals will receive a $1200 tax rebate and married couples a $2400 rebate. The Fed followed through, with comments about lifting some barriers for bank loans (small businesses will need these now), buying commercial paper and some state and corporate bonds, and making accounting changes. Spain announced a €200B package and Germany a €150B package. The ECB added €750b (sovereign and corporate) QE to maintain market liquidity throughout this crisis.

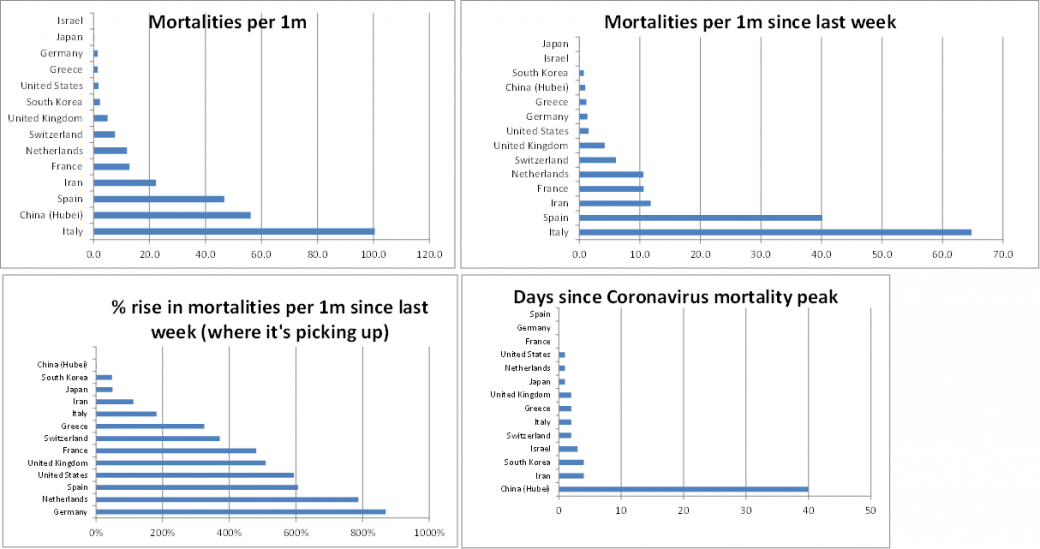

The markets follow mortalities, as the data is more reliable than “confirmed cases”, given lack of testing, especially in the west. Italian mortalities overtook those of China, but appear to be flattening at their current levels. Spain has now become the next big hub, while France, the Netherlands, Switzerland, the UK and the US are seeing a pickup in deaths. Most of Europe is in lockdown, while the UK followed other countries and some US states in declaring a curfew. Good news to focus on: Italian mortalities might have reached a peak, while Chinese authorities decided to lift the lockdown in Wuhan, after more than two months, as no new cases have emerged in almost a week. Having said that, a few incidents in Hubei have worried authorities that the virus might flare up as the measures are relaxed.

The world after this crisis

As far as policy response is concerned, we have to acknowledge that a massive policy initiative, dwarfing that of 2008, was undertaken. 2008’s response, Quantitative Easing, fixed the problem at the time, credit flow, but has resulted in a lot of unintended consequences, such as rock-bottom rates for a generation, income stagnation and inequality in income distribution, which eventually turned into resentment for the status quo and caused significant political turbulence.

2020’s response is much bigger which means consequences might be higher as well. Either the response overshoots, undershoots, or is just right. If it overshoots, growth rates versus the past will rise, but so might inflation, as a lot of money is directed towards consumers. With quickly rising levels of global debt, inflation might sound like a good idea (we can inflate it away), but to do this central banks would have to meaningfully raise interest rates and roll back QE, which they have been unable to do for over 12 years. With heightened unemployment, governments would probably object to such a course of action. If policy undershoots, then growth rates may not recover, even to their previous sluggish levels. Getting the policy “just right” and without collateral damage is of course a possibility, but a difficult once given its massive scope. At best, we can hope for successfully adjusting recovery policies as we go along, to balance growth, unemployment and inflation. Time is of the essence. For every day the economy remains in lockdown, the ensuing economic damage is disproportionate.

- Debt: We expect that a world, already inundated with debt at 253% of global GDP, will experience even more elevated levels of debt, as countries expand their fiscal policies to mitigate some of the economic damage. We believe that eventually that a solution to global debt will be sought, a compromise between creditor and debtor nations.

- Unemployment: Unemployment will probably rise significantly as the economy is reshuffled.

- Banks: Bank capitalisation might weaken, as some post-2008 measures are lifted to facilitate liquidity. We fully expect the global geopolitical deck may be reshuffled.

- Europe: The European common currency might be tested again, as centrifugal forces exacerbate tension

- Business: The Business map and practices may be re-thought, depending on length of crisis. We expect more emphasis on tele-commuting and cost controls and less emphasis on regulation, to facilitate the economic recovery.

Larger and listed companies may have an advantage after the virus crisis, as they would be more likely to have a cash cushion and retained more of their staff.

Capitalism has survived the Cold War, a Nuclear Crisis (1962), a change in the monetary system and ensuing inflation (1971-1985), a global banking crisis (1990), the dot.com bubble (2000), 9/11, and a total breakdown in 2008. We expect that this crisis, which does have an end date, will eventually see the continuation of the system. However, policy makers around the world will be pressured to re-think some of the less efficient consequences of modern capitalism, to make sure resentment of the status quo is eventually alleviated.

In the meantime, we can no longer view stock and bond markets as fully functioning to raise and allocate capital. With over 1 billion people virtually in house arrest, including New York and London, it is difficult to consider market movements as fully “efficient”. Investment meetings are mostly taking place for maintenance and M&A activity is freezing. Fund managers will be watching their holdings, mitigating losses wherever possible, but probably won’t be investing significantly until more clarity has been reached. We don’t believe that major investment decisions will be made by investors who are locked in their living room. Thus, we cannot look at traditional market metrics, such as valuations, to flag a possible recovery or take market movements hereafter at face value.

Important information

All sources: Refinitiv. The information contained in this document is believed to be correct but cannot be guaranteed. Opinions constitute our judgment as at the date shown and are subject to change without notice. This document is not intended as an offer or solicitation to buy or sell securities, nor does it constitute a personal recommendation. Where links to third party websites are provided Mazars Financial Planning Ltd accepts no responsibility for the content of such websites nor the services, products or items offered through such websites.

Mazars Financial Planning Ltd is a wholly owned subsidiary of Mazars LLP, the UK firm of Mazars, an integrated international advisory and accountancy organisation. Mazars Financial Planning Ltd is registered in England and Wales No 3172233 with its registered office at Tower Bridge House, St Katharine’s Way, London E1W 1DD. Mazars Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority.