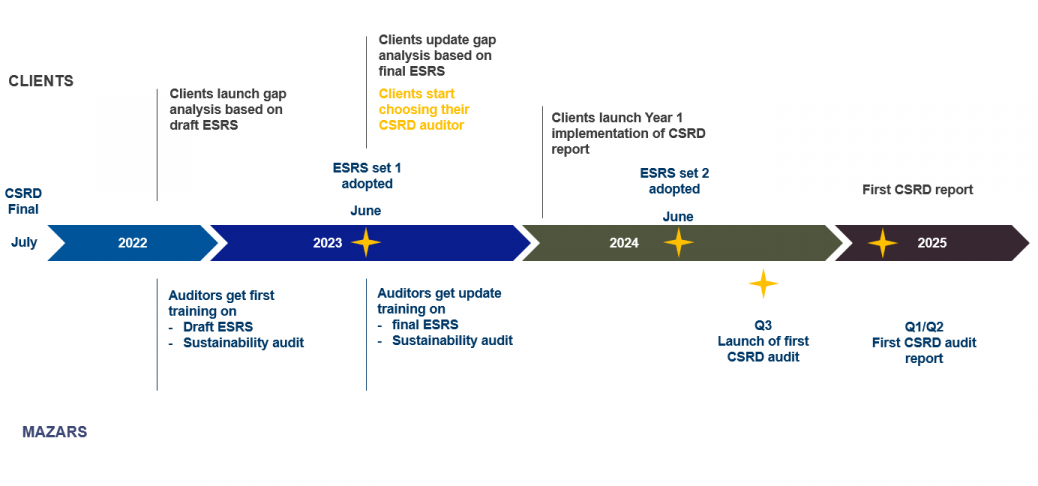

It is most likely, based on the CSRD proposals, that the first tranche of companies will need to apply European Sustainability Reporting Standards (ESRSs) for 2024-year ends; others would follow in a phased application. Limited assurance would be required initially, with the intent of moving to reasonable assurance in time.

The CSRD, if it is adopted as proposed, requires EFRAG to draft, and the European Commission to adopt, an initial set of ESRSs by 30 June 2023 and further standards by 30 June 2024. In response, EFRAG set up various working groups to do the groundwork on the draft standards. The first set of ESRSs has been issued formally by the newly created EFRAG Sustainability Reporting Board as exposure drafts for public consultation.

What companies would be impacted?

Under the CSRD proposal, companies that are currently obliged to report under the Non-Financial Reporting Directive (NFRD) – i.e., large public-interest companies with more than 500 employees – would be required to report under ESRSs for reporting periods beginning on or after 1 January 2024 (i.e., in reports issued in 2025). Other large entities would need to report under the CSRD from 1 January 2025, and small and non-complex institutions, captive insurers, and certain listed small and medium-sized enterprises (SMEs) would be due to implement the CSRD by 1 January 2026. The latter would have an option to opt out until 1 January 2028. Large companies are defined as those that meet two of the following criteria:

- over 250 employees;

- over EUR 40 million net revenue; and

- over EUR 20 million total assets.

In addition, companies or groups outside the EU that generate net revenue of more than EUR 150 million in the EU would fall under the CSRD from 1 January 2028.

The 13 proposed ESRS topics cover:

- one standard on general principles for sustainability reporting;

- one standard on overarching disclosure requirements; and

- specific disclosure requirements focused on 11 ESG topics.

Under the proposals, companies would need to publish separate sustainability statements as part of their management reports containing sector-agnostic, sector-specific, and company-specific disclosures.

ESRSs would require companies to provide significantly more disclosures in the management report. Companies should start thinking about the effects that the standards would have on processes and systems of internal controls. They need to ensure that the quality of sustainability information is equivalent to financial information and could be audited initially with limited and later reasonable assurance.

Should you need our support to navigate these changes as they are implemented over the coming years, please do not hesitate to reach out to our experts featured below.